DMD FinTech Trend Report — Powered by Advantage Evans Academy📈

🆕 MICRO LESSONS ARE HERE 🆕

Are you ready to take your understanding of fintech, crypto, and digital innovation to the next level—without breaking the bank? Starting February 1st, unlock exclusive access to bite-sized, power-packed learning modules to help you separate fact from fiction and go from cash to crypto safely, legally and confidently.

For just $5/month, you'll gain access to:

✨ Monthly live masterclasses with Q&A to keep you ahead of the curve.

✨ Premium video content designed to fit into your busy schedule.

✨ Exclusive resources to navigate the ever-evolving digital economy with confidence.

This isn’t just another course—it’s a community-driven learning experience for fintech professionals, investors, and curious minds ready to embrace the future of money.

💡 Don’t miss out on this opportunity to empower your financial journey while staying on top of the latest trends in blockchain, crypto, and wealth-building strategies.

📰LEAD STORY

Black Banking: From Reconstruction to the Web3 Economy

The history of Black banking in America is a story of resilience and systemic challenges. From the Reconstruction era to today’s digital economy, Black communities have fought for financial inclusion, often facing discrimination and economic setbacks. Now, Web3, cryptocurrency, and decentralized finance (DeFi) offer new opportunities to build lasting wealth beyond traditional banking institutions.

Early Black Banking and Economic Struggles

After the Civil War, the Freedman’s Savings and Trust Company was created in 1865 to help Black Americans secure their financial futures. However, corruption and mismanagement led to its collapse in 1874, wiping out the savings of over 61,000 Black depositors. Despite this setback, Black entrepreneurs established the first Black-owned banks, such as True Reformers Bank in 1888 and Capital Savings Bank in 1888, providing critical financial services to underserved communities.

These institutions were essential for economic empowerment, but they faced challenges like lack of capital, discriminatory policies, and economic downturns. The Great Depression further reduced their numbers, but Black banks remained vital during the Civil Rights era, supporting homeownership and business growth.

Decline of Traditional Black Banks

By the 1970s, Black banking saw a resurgence, with institutions like Carver Federal Savings Bank and OneUnited Bank offering financial stability. However, systemic barriers persisted. The 2008 financial crisis hit Black-owned banks hard, leading to closures. Today, only 44 Black-owned financial institutions remain, managing a fraction of the assets controlled by major banks. Limited access to capital and industry consolidation have further weakened their presence.

Web3 and the Future of Black Wealth

Web3 technologies, including blockchain, cryptocurrency, and decentralized finance, present new opportunities to bypass traditional financial barriers. DeFi enables individuals to lend, borrow, and invest without intermediaries. Cryptocurrency provides an alternative store of value, protecting wealth from inflation and systemic exclusion. Tokenized ownership allows Black entrepreneurs to build wealth through digital assets, while AI-driven financial tools create transparency and accessibility.

Conclusion

Black Americans have historically sought economic empowerment through banking, but systemic barriers have made lasting wealth difficult to achieve. Web3 offers a new path—one where financial independence is secured through decentralized technology, ensuring that wealth remains in the hands of the people. By embracing these innovations, Black communities can build indestructible wealth and overcome historical financial exclusion.

Read more about how black-owned banks and banking professionals can get in formation for the coming changes as a result of the new administration’s pro-crypto policies opening up crypto markets and also increasing risks to unprepared institutions, investors and consumers.

📩 Read the full article via LinkedIN and be sure to follow and connect.

NEWS DIGEST

AD:📈Unlock the secrets of profitable trading and start your journey to financial freedom today with Trade & Travel📈!

🎧NEW @ CONFIDENTLY CRYPTO

🎧 Where to Listen:

🏆EARN BITCOIN CASHBACK

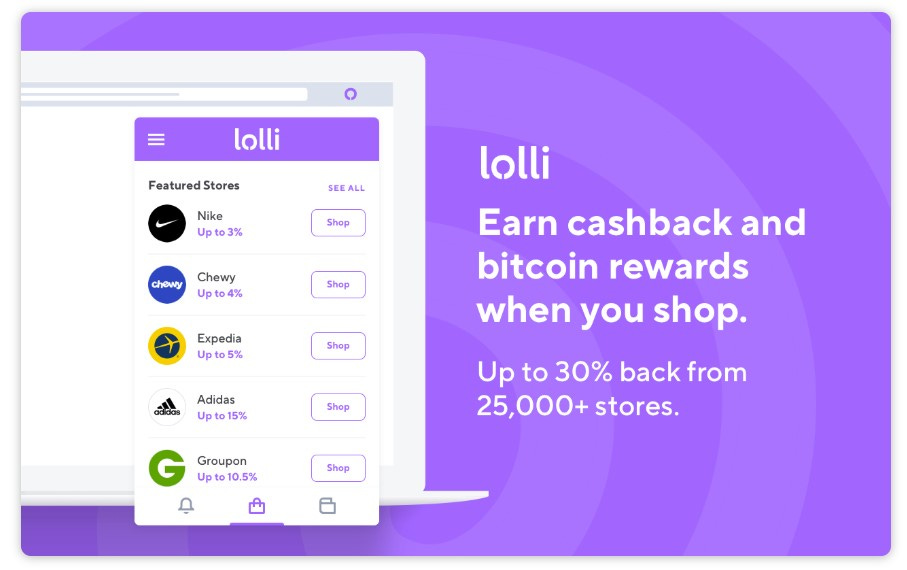

Join Lolli for FREE, get cash and bitcoin back every time you shop this holiday season. Lolli is a Tech Intersect Podcast partner and I use it myself!

Ready to Learn & Earn? Become a Premium Subscriber + Access Micro Lessons