The DMD FinTech Trend Report — Powered by Advantage Evans Academy📈

Available in paperback & e-book at Amazon.com and wherever books are sold.

A 2024 ERIC HOFFER BOOK AWARD CATEGORY FINALIST

Illegal? A fad? A scam? Unregulated? What is Cryptocurrency?

Digital Money Demystified is an expertly researched, engaging, and informative guide that separates fact from fiction in the wild world of crypto by tackling the most common myths of this emerging asset class.

UPCOMING EVENTS 📅

🌟REGISTER NOW🌟: Free FinTech Law Briefings via Zoom. Learn More.

Sept 4, 2024, 3:00 p.m. ET

Sept 18, 2024, 3:00 p.m. ET

LEAD STORY 📰

Kamala Harris Hints At Pro-Crypto Pivot With Key Adviser Picks

By Tonya M. Evans, Penn State Dickinson Law Professor, Speaker, Consultant & Author of Digital Money Demystified

Rules, not rulers—this is a core tenet of crypto. The distrust of government and centralized power is integral to the decentralized peer-to-peer cash envisioned by bitcoin creator Satoshi Nakamoto. Under the Biden administration, the crypto industry has faced even more aggressive regulatory actions than before, increasing distrust among stakeholders.

Despite skepticism that Vice President Kamala Harris, if elected, might continue Biden’s anti-crypto stance, recent campaign adviser appointments might suggest otherwise. […]

📩 Read the full article via Forbes.com.

NEWS DIGEST

All Subscribers🪙

Crypto's Hidden Figures: Black Women Shaping the Future of Blockchain

MetaMask Starts Rollout of Blockchain-Based Debit Card Developed With Mastercard, Baanx

Democratic Crypto Supporters Call for Crypto-Friendly Party Platform

FEATURED VIDEO

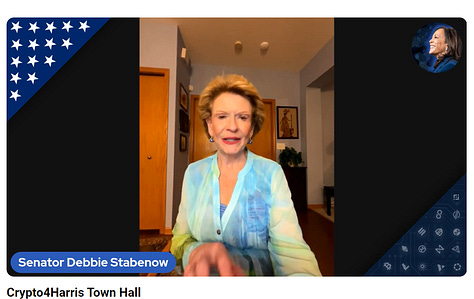

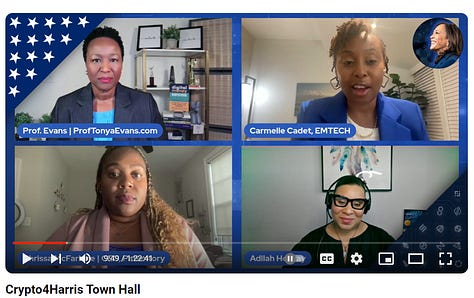

#Crypto4Harris Town Hall

August 15, 2024

The Crypto4Harris Town Hall, held on August 15, 2024, was a significant event designed to rally support for Democratic presidential candidate Kamala Harris by promoting the adoption and development of cryptocurrency and blockchain technology in the United States. This campaign-led initiative, aligned with the Democratic Party, brought together a diverse group of industry stakeholders, policymakers, and thought leaders to explore the role of crypto and blockchain in fostering American innovation and to discuss the future regulatory landscape.

Key Takeaways:

Prominent Speakers:

Chuck Schumer: Senate Majority Leader Chuck Schumer made headlines during the event by announcing his commitment to advancing legislation that supports the growth of the crypto industry while ensuring robust consumer protections. Schumer's involvement underscored the importance of integrating crypto policy into the broader legislative agenda.

Debbie Stabenow: Senator Debbie Stabenow, who has been influential in shaping agricultural and financial policies, spoke about the potential of blockchain technology to revolutionize supply chain management and enhance transparency in various sectors. Her comments highlighted the need for a regulatory framework that encourages innovation while addressing potential risks.

Notable Panel Discussion:

Professor Tonya Evans: An important panel during the event was led by Professor Tonya Evans, who is a renowned expert in blockchain law and digital assets. The panel focused on the legal and regulatory challenges facing the crypto industry and explored strategies for fostering a more supportive environment for innovation. Evans emphasized the need for a nuanced approach to regulation that balances the interests of consumers, businesses, and the broader economy.

Campaign Goals:

The Crypto4Harris campaign aims to move beyond the "legacy issues" of the previous administration, such as ongoing litigation against crypto businesses, and work towards establishing a more favorable regulatory environment. The campaign envisions a "big tent" approach, welcoming participants from all political backgrounds who are interested in understanding the benefits of crypto for American innovation.

The initiative seeks to collaborate with a potential Harris administration to promote policies that support entrepreneurship, investment, and consumer adoption in the crypto space.

Focus on Innovation and Entrepreneurship:

Speakers and panelists at the event highlighted the critical role of fostering an environment conducive to innovation. The discussions underscored the importance of creating a regulatory framework that supports the growth of the crypto industry while protecting the interests of American consumers and businesses.

The Crypto4Harris Town Hall was a pivotal moment in galvanizing support for a pro-crypto policy agenda within the Harris campaign, signaling a commitment to positioning the United States as a leader in digital assets and blockchain technology. Watch the Replay

FINTECH LAW DIGEST

On the Legal Front ⚖️

Book me for your next event or corporate training! Learn more

EU MiCA law: Crypto firm Circle gets French license for stablecoin

Crypto firm Circle, known for issuing the USDC stablecoin, has received a significant boost by securing a French license under the EU's new Markets in Crypto-Assets (MiCA) regulation. This license, granted by the French financial authority, positions Circle as one of the first [ …📈]

Trump says he would fire SEC Chair Gary Gensler on Day One. It’s not that easy

Former President Donald Trump recently stated that if re-elected, he would fire SEC Chair Gary Gensler on his first day in office. However, legal and procedural hurdles make such a move far from straightforward. The SEC Chair can only be removed for […📈]

Ripple’s Case Bodes Well for Other Crypto Companies Battling SEC

Ripple's legal battle with the SEC has become a landmark case with implications for the entire crypto industry. Recent developments suggest that Ripple may be gaining an advantage, potentially setting a favorable precedent for […📈]

📽️UNLOCK the FinTech Law Virtual Briefing Replays when you subscribe to the Premium Edition.📽️

🧐 How do you think the ongoing Ripple vs. SEC legal battle will shape the future of cryptocurrency regulation?

Last week, we explored some critical developments in fintech law that could set the stage for the next big wave in digital finance. In our discussion, we tackled the long-awaited resolution of the Ripple and SEC lawsuit, delving into how this case might impact regulatory clarity for the entire crypto industry.

We also examined the recent enforcement action against Customer's Bank by the Federal Reserve for AML/BSA compliance lapses, highlighting the importance of proactive compliance for financial institutions in an evolving regulatory landscape.

📈 Unlock full access to cutting-edge fintech law news, in-depth trends, and exclusive audio and video content. Upgrade to a paid subscription today and stay ahead in the world of finance and technology!

Keep reading with a 7-day free trial

Subscribe to AdvantageEvans Web3 Economy News & Trend Report to keep reading this post and get 7 days of free access to the full post archives.